osceola county property tax estimator

Williamson County collects the highest property tax in Tennessee levying an average of 187900 056 of median home value yearly in property taxes while Decatur County has the lowest property tax in the state collecting an average tax of 33300 05 of median home. Washtenaw County collects the highest property tax in Michigan levying an average of 391300 181 of median home value yearly in property taxes while Luce County has the lowest property tax in the state collecting an average tax of 73900 086 of median home value per year.

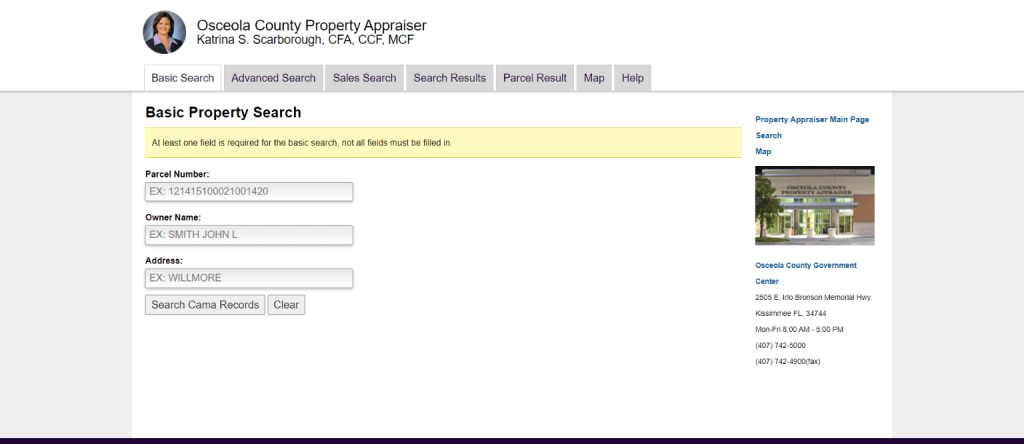

Property Search Osceola County Property Appraiser

The exact property tax levied depends on the county in Michigan the property is located in.

. The exact property tax levied depends on the county in Tennessee the property is located in.

Osceola County Property Appraiser How To Check Your Property S Value

Osceola County Property Appraiser How To Check Your Property S Value

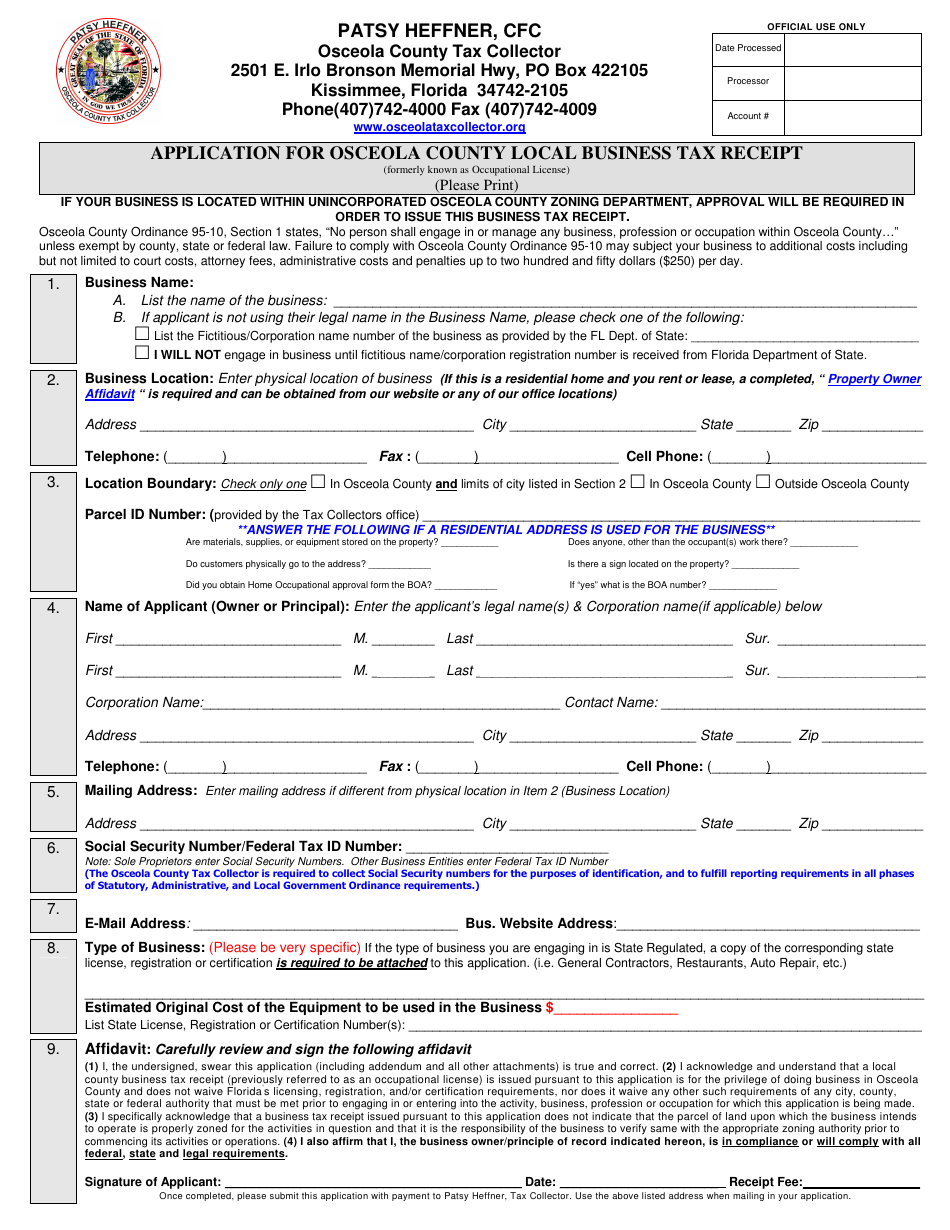

Osceola County Florida Application For Osceola County Local Business Tax Receipt Form Download Fillable Pdf Templateroller

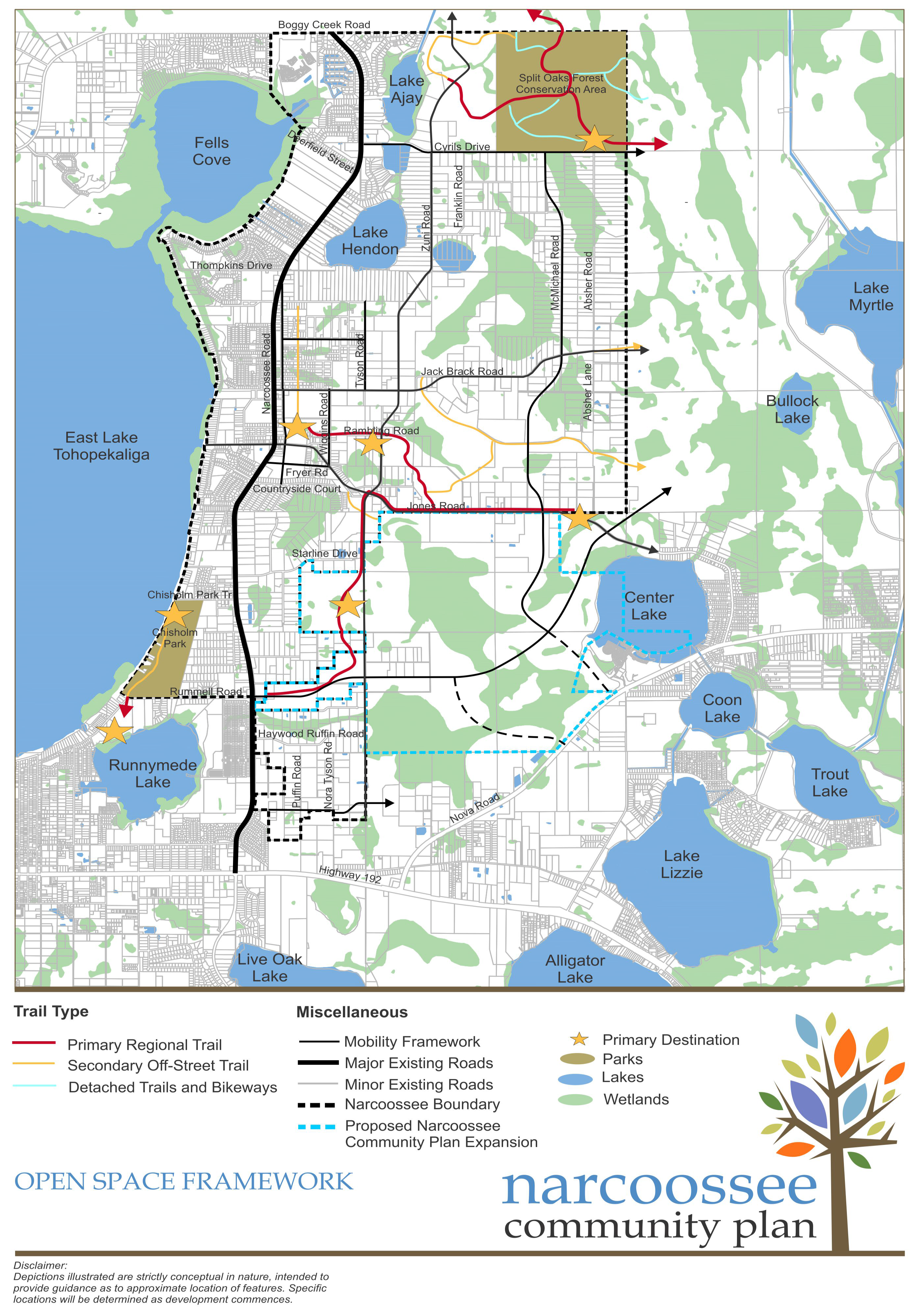

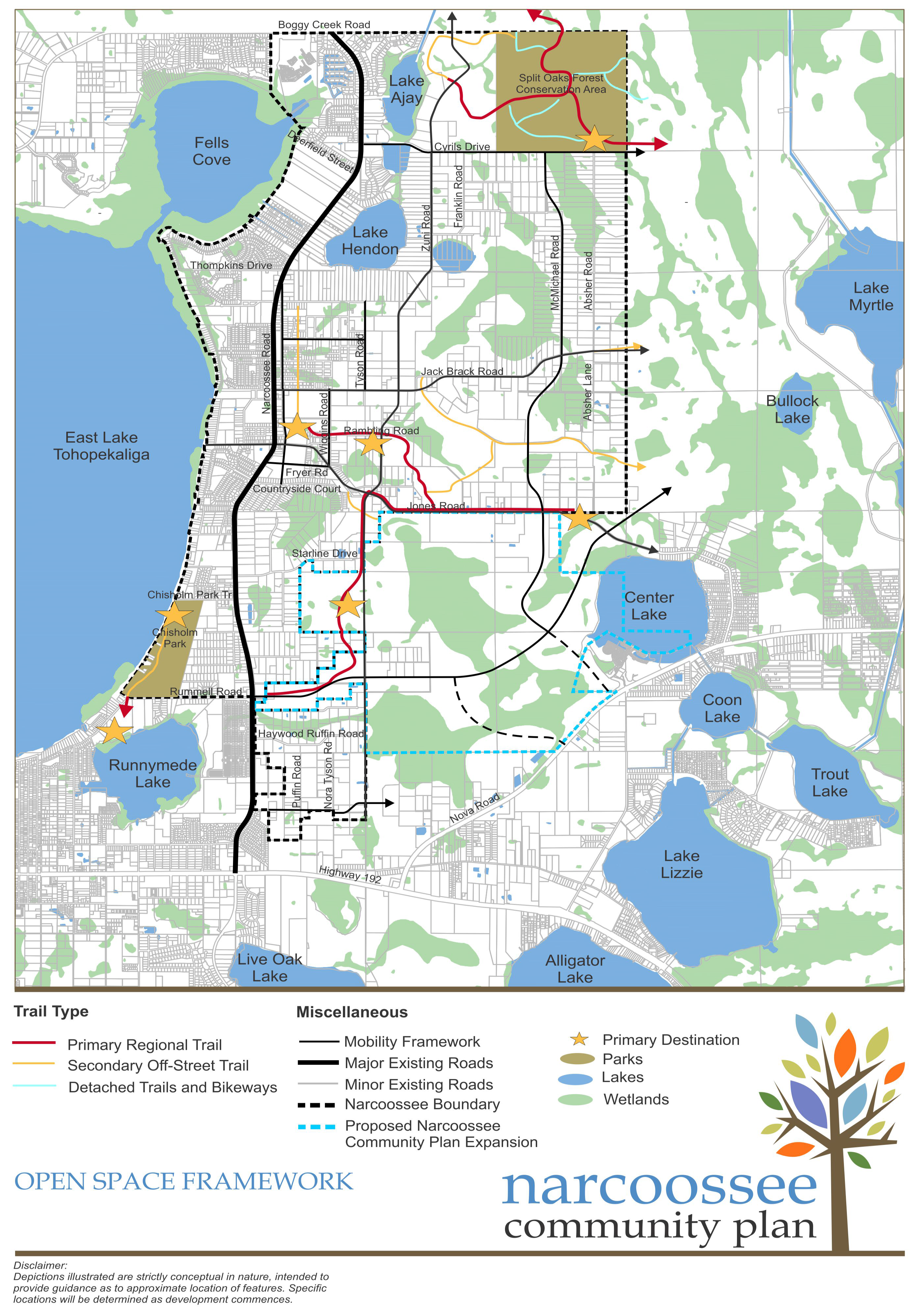

Chapter 4 Site Design And Development Standards Land Development Code Osceola County Fl Municode Library

Osceola County Property Appraiser How To Check Your Property S Value

Property Search Osceola County Property Appraiser

Osceola County Florida Application For Osceola County Local Business Tax Receipt Form Download Fillable Pdf Templateroller

Free Credit Report Offers Extended Complaints Have Increased Florida Realtors In 2021 Credit Score Check Credit Score Better Credit Score

Property Search Osceola County Property Appraiser

Curriculum Amp Instruction Consent Agenda Osceola County School

![]()

Osceola County St Cloud Propose Smaller 2021 22 Budgets Osceola News Gazette